Business for sale

Looking for a business for sale but not sure where to start? Buying an existing business can be a faster, safer, and more profitable path to entrepreneurship than launching one from scratch. Whether you’re a first-time buyer or a seasoned investor, knowing what to look for—and where to look—can make all the difference. In this guide, we’ll walk you through the key steps to finding and purchasing the right business for your goals.

How to Find the Right Business for Sale: A Complete Guide for Aspiring Entrepreneurs

Buying an existing business can be one of the smartest ways to enter the world of entrepreneurship. Instead of starting from scratch, you inherit an established operation, a customer base, and immediate cash flow. But finding the right business for sale isn’t always straightforward. This guide will walk you through every step of the process so you can make an informed decision and set yourself up for long-term success.

Why Buy a Business Instead of Starting One?

Starting a business from the ground up is exciting, but it also comes with a high level of risk. According to research, about 20% of new businesses fail within the first year. Buying an established business for sale gives you a head start in many areas:

- Proven Business Model: You’re investing in something that has already demonstrated success.

- Immediate Revenue: You don’t need to wait months or years to generate income.

- Trained Staff: Many businesses for sale include experienced employees who already understand the operations.

- Existing Customers: A solid customer base provides immediate sales opportunities.

Where to Find a Business for Sale

The good news is there are multiple channels to explore when looking for a business for sale. Each has its pros and cons, depending on your industry and budget.

1. Online Marketplaces

Websites like BizBuySell, BizQuest, and Flippa offer thousands of listings. You can filter by industry, location, revenue, and asking price.

- BizBuySell: Focused on brick-and-mortar businesses.

- Flippa: Ideal for online and digital businesses.

- LoopNet: Good for commercial real estate opportunities.

2. Business Brokers

Business brokers are like real estate agents, but for businesses. They can help you:

- Evaluate listings

- Negotiate deals

- Manage paperwork and legal issues

3. Networking

Talk to industry professionals, attend business meetups, or join online groups. Sometimes, the best opportunities aren’t publicly listed.

4. Franchise Resales

If you’re looking for a franchise, some franchisors have existing franchisees looking to exit. These resales can offer the support of a larger brand with the benefits of an operating business.

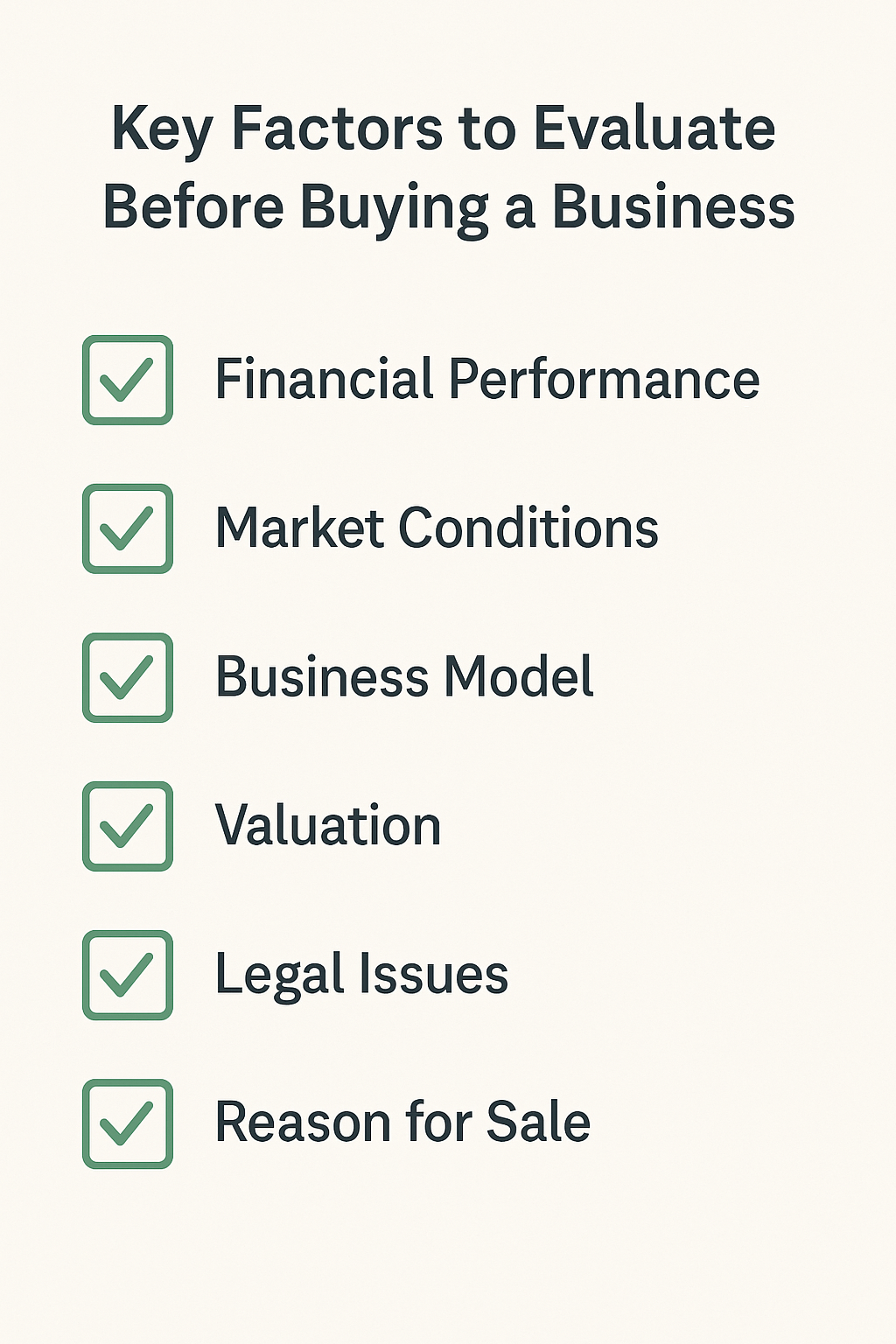

How to Evaluate a Business for Sale

Not every business for sale is worth buying. Some may look good on paper but have hidden issues. Here’s how to conduct a thorough evaluation:

1. Financial Performance

Ask for:

- Balance sheets

- Profit & loss statements

- Tax returns for the past 3 years

Look for consistent revenue, profitability, and manageable debt.

2. Customer and Supplier Contracts

Evaluate any agreements in place. Are they transferable? Are there long-term commitments?

3. Assets and Inventory

What’s included in the sale? Equipment, inventory, software licenses, and intellectual property should be clearly outlined.

4. Legal Compliance

Check for licenses, permits, and any outstanding legal issues.

5. Reputation and Online Presence

Research the business’s reviews, social media activity, and brand reputation.

Due Diligence Checklist

Before finalizing your purchase, conduct due diligence to ensure the business is what it claims to be.

✅ Legal Documents

- Articles of incorporation

- Business licenses

- Lease agreements

- Employee contracts

✅ Financial Documents

- Income statements

- Tax returns

- Bank statements

✅ Operational Information

- Day-to-day processes

- Staff responsibilities

- Supplier and vendor contacts

✅ Technology & Assets

- Website and domain names

- Patents or trademarks

- Equipment and software

Due diligence can take weeks or even months, depending on the size and complexity of the business. Consider hiring an accountant and legal expert to help.

Financing Options to Buy a Business

Buying a business for sale isn’t cheap, but there are several financing methods available:

1. SBA Loans

The U.S. Small Business Administration (SBA) offers loans with favorable terms and low-interest rates, specifically designed for purchasing existing businesses.

- Requires good credit

- Often involves a down payment of 10–20%

2. Seller Financing

In this arrangement, the seller finances part of the purchase. You make payments over time, often with interest. This is common in smaller or family-owned businesses.

3. Bank Loans

Traditional banks can also finance business acquisitions, although approval is typically stricter than SBA loans.

4. Private Investors or Partnerships

Bring in investors or partners to share the cost and risk.

5. Your Own Savings

If you’re financially prepared, using your own capital can eliminate debt and give you more flexibility.

Common Mistakes When Buying a Business for Sale

Avoiding these common pitfalls can save you from future headaches:

❌ Not Doing Proper Due Diligence

Always dig deeper than what’s presented. Financial fraud and hidden debts are more common than you’d think.

❌ Overpaying

Don’t let emotions drive your purchase. Use business valuation tools and get a third-party appraisal if needed.

❌ Ignoring Staff Culture

An established team might resist change. Understand the company culture and how you’ll fit in as the new owner.

❌ Failing to Plan Post-Acquisition

Buying is just the beginning. You need a solid strategy for operations, marketing, and growth post-purchase.

Conclusion

Buying a business for sale can be a strategic move that fast-tracks your journey into entrepreneurship. Instead of starting from scratch, you’re stepping into a functioning operation—with customers, systems, and a revenue stream already in place. But success doesn’t come from just finding a listing. It comes from careful evaluation, solid due diligence, smart financing, and a clear plan for what comes next.

Whether you’re eyeing a local shop, an online store, or a franchise resale, the key is to stay patient, ask the right questions, and never skip the details. The right opportunity can set you up for long-term growth, financial freedom, and the satisfaction of running a business that fits your lifestyle and goals.

So take the next step. Start exploring your options, reach out to sellers, and remember—your perfect business for sale might be just one smart decision away.

Frequently Asked Questions (FAQ)

1. What is the best website to find a business for sale?

Some of the top platforms include BizBuySell, BizQuest, LoopNet, and Flippa. Your choice depends on the type of business you’re interested in—brick-and-mortar or online.

2. How much does it cost to buy a small business?

Costs vary greatly, ranging from $10,000 for a small online store to millions for an established enterprise. Factors include revenue, assets, location, and market demand.

3. Can I buy a business with no money down?

It’s possible, especially with seller financing or investor partnerships. However, it’s rare and typically requires negotiation skills and a strong business plan.

4. What is due diligence in buying a business?

Due diligence is the process of thoroughly reviewing a business’s financials, legal obligations, operations, and reputation before making a purchase.

5. Is buying a business risky?

Yes, like any investment. But it can be less risky than starting a business from scratch—especially if you do your research and seek professional advice.